Kenyan electricity consumers could soon see a sharp increase in their monthly power bills if a controversial proposal to impose wayleave charges on Kenya Power’s (KPs) infrastructure is implemented.

The utility company has warned that the progress made over the past year in reducing electricity costs, driven by a stronger shilling and strategic regulatory measures, could be reversed, with tariffs potentially rising by as much as 30%.

The proposal, which county governments and private landowners floated, seeks to introduce a Sh200-per-meter levy on KP’s extensive 319,000-kilometer transmission and distribution network.

Proponents argue that landowners should be compensated for the use of their property by power lines, transformers, and pylons, claiming that KP has long benefited from public and private land without providing adequate compensation.

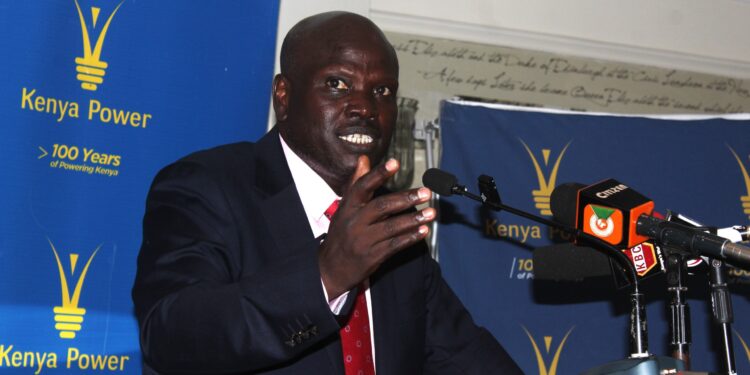

If implemented, KP Managing Director and Chief Executive Officer (CEO) Joseph Siror said the levy would translate to an annual cost of Sh63.8 billion, a financial burden that KP would likely pass on to consumers through higher electricity tariffs.

“Kenya Power has over 319,000 kilometres of power lines across all 47 counties. The introduction of wayleaves on power lines will impact retail tariffs. Under the proposal to charge Wayleaves on electricity infrastructure for Sh200 per meter, this translates into Sh63.8 billion per year. This is approximately 30% of the energy sector’s revenue requirements which must be recovered from the monthly electricity bills. The overall impact is that electricity will become unaffordable to a majority of Kenyans,” he remarked during an engagement with the Kenya Editors Guild.

Siror further emphasized that the Energy Act 2019 explicitly prohibits the imposition of levies on public energy infrastructure without regulatory approval, a safeguard designed to protect consumers from arbitrary cost increases.

The warning comes at a time when Kenya’s electricity sector has been experiencing relative price stability. Since the introduction of a three-year tariff plan in April 2023, base energy costs have gradually declined, from Sh19.04 per unit in 2023 to the current Sh17.94. The strengthening of the Kenyan shilling against the US dollar has also played a crucial role in reducing foreign exchange and fuel costs, helping to keep electricity prices in check.

However, this stability remains fragile. External factors such as global energy prices, currency fluctuations, and policy decisions can easily disrupt the delicate balance. If wayleave charges are introduced, the resulting increase in power costs could have far-reaching consequences beyond household electricity bills.

Industries, which rely heavily on affordable electricity, would face higher operational costs, potentially driving up the prices of goods and services. This could undermine Kenya’s competitiveness as a manufacturing and investment hub, making it less attractive to foreign investors.

Already, Kenya’s inflation rate has shown signs of creeping upward. Data from the Kenya National Bureau of Statistics (KNBS) indicates that annual consumer price inflation stood at 3.5% in February 2025, up from 3.3% in January. Historically, energy prices have played a significant role in driving inflation. Between 2020 and 2023, electricity prices surged by 60% for industries and almost 80% for households, exerting pressure on the overall cost of living.

Economic studies have long established a link between energy costs and inflation in Kenya. A 2009 study by Paul Kiprop Lagat, Wilfred Nyangena, and Benson Kirui found that a 10% increase in oil prices led to a 0.5% rise in inflation in the short run and a 1% increase in the long run. Given this correlation, any policy that raises electricity costs such as the proposed wayleave charges, risks fueling inflationary pressures, further squeezing households and businesses.

ALSO READ: More Agony As State Triples EPRA Levy